Connects decision-makers and solutions creators to what's next in quantum computing

Q&A with JPMorgan Chase and QC Ware

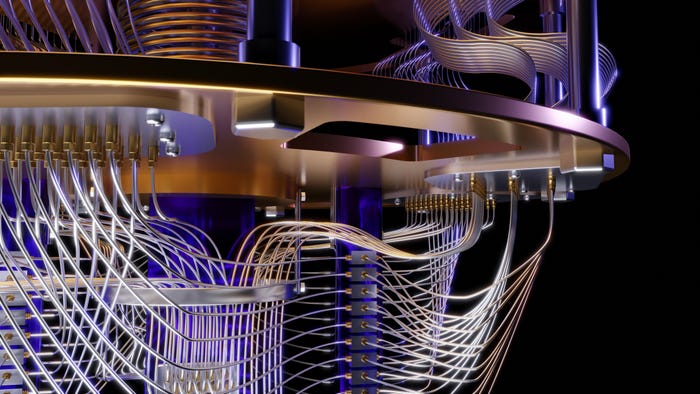

JPMorgan Chase and quantum software and services company QC Ware recently published a study that showed quantum machine learning can train models for “deep hedging” more efficiently than classical computers alone.

JPMorgan Chase head of global technology applied research Marco Pistoia, QC Ware head of quantum algorithms Iordanis Kerenidis and QC Ware CEO Matt Johnson talked to Enter Quantum about the study and how the findings might benefit future customers.

Enter Quantum: JPMorgan Chase is an early quantum adopter. Out of the companies it is working with, why was QC Ware a good fit for this particular study?

JPMorgan Chase and QC Ware: QC Ware’s scientific publications in the past have demonstrated expertise in devising quantum financial algorithms. This commonality in research interests made it natural for JPMorgan Chase to start a collaboration with QC Ware to explore a quantum application for hedging derivatives, an important financial use case at the firm.

AI is used for several financial services applications. Why did you choose deep hedging for this study?

Deep hedging’s powerful, deep reinforcement learning is highly complex, making the case for studying it in a quantum environment.

Which parts of the research were carried out on classical and quantum computers?

We used classical computers to simulate what a quantum computer would be able to execute, alongside hardware maturity. Simulated results, in general, are also used as reference values to verify that the quantum algorithm produces valid results when executed on real hardware. The hardware experiments, which show the results using currently available quantum hardware, demonstrate that the algorithm is performing as expected when executed on real quantum hardware.

What benefits could JPMorgan Chase clients expect from portfolios incorporating quantum-powered AI deep learning?

Future portfolios that incorporate quantum-powered AI deep learning could have enhanced hedging capabilities, offering decreased risk.

What other uses for quantum computing use cases is JPMorgan Chase investigating?

The global technology applied research team has published research results for other use cases, such as portfolio optimization and natural language processing. The team’s focus is to address use cases that are most relevant to the firm, providing research findings to inform future decision-making at JPMorgan Chase. The team is hiring motivated researchers in both quantum computing and quantum communication!

About the Author(s)

You May Also Like

.png?width=100&auto=webp&quality=80&disable=upscale)

.png?width=400&auto=webp&quality=80&disable=upscale)