Connects decision-makers and solutions creators to what's next in quantum computing

Citi, Classiq, AWS Test Quantum Finance Portfolio Optimization

Experiment showed that hybrid quantum running on Amazon Braket could be used to study this complex problem

Citi Innovation Labs, part of the Citi Group banking and financial services company, has completed a study into the potential for quantum computing in portfolio optimization using Amazon Braket with Classiq and Amazon Web Services (AWS).

The study investigated the potential of quantum computing to improve on traditional methods in financial modeling, the feasibility of quantum solutions for complex financial problems and the ongoing evolution of quantum algorithms and their application in the finance sector.

According to an AWS blog, Classiq’s stack suited the task as it enables modeling at a higher level of abstraction. This meant it was easier for subject-matter experts to design quantum algorithms. Classiq’s toolset was accessed via AWS’s Amazon Braket cloud quantum service.

Portfolio optimization is the process of selecting the optimal mix of assets, such as stocks, bonds, and other financial instruments, to achieve the highest possible returns for a given level of risk. Future quantum computers should be able to consider all these interrelated factors and demonstrate quantum advantage, defined as solving a real-life computational problem that classical computers cannot.

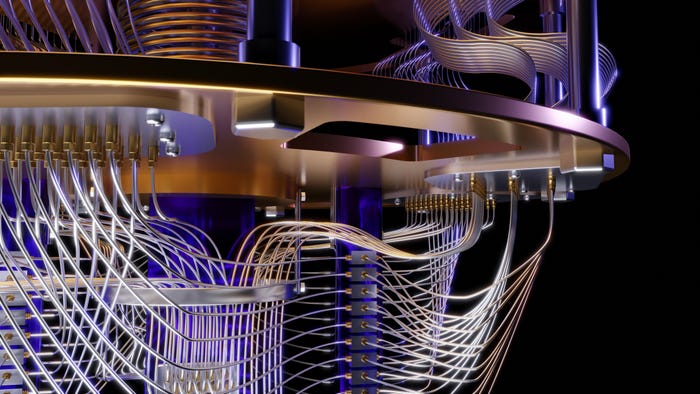

However, current noisy intermediate-scale quantum (NISQ) computers have a limited qubit count and are subject to noise limiting their capacity. NISQ computers, or their successors, could process the variational quantum algorithms that could demonstrate quantum advantage.

One that applies to the portfolio optimization use case is known as the quantum approximate optimization algorithm (QAOA). The partners used the QAOA quantum algorithm for portfolio optimization, investigating how adjustments to the algorithm’s penalty factor impacted the algorithm’s performance when introducing constraints to the problem.

QAOA is a hybrid algorithm that uses both classical and quantum computation. The algorithm searches through all potential solutions using a mixer layer and the quantum circuit parameters are then fine-tuned classically in an iterative manner until an optimal result is returned.

For the study, the partner collected historical stock price data for companies including Apple, Walmart, Tesla, GE, Amazon, and Deutsche Bank. They used this data to calculate the expected returns and to set up the quantum circuit for optimized portfolio construction.

According to Classiq, its version of QAOA method is an easy way of writing the optimization problem, configuring circuit layout and mixer type, selecting the classical optimizer and executing on any simulator or quantum computer.

Citi Innovation Labs said that while the experiment did not demonstrate quantum advantage with NISQ computers, it did show how Classiq running on Amazon Braket could be used to study this complex problem.

About the Author(s)

You May Also Like

.png?width=100&auto=webp&quality=80&disable=upscale)

.png?width=400&auto=webp&quality=80&disable=upscale)